Mortgage Blog

Honesty-Integrity-Commitment-Professionalism

Category: Financing (48 posts)

What Happens When You Invest $100,000 in an RRSP, TFSA, or Taxable Account?

May 28, 2025 | Posted by: Kiruban Kana

If you're saving for the future—whether it's retirement, a home, or just financial freedom—where you invest matters just as much as how much you invest. Kiruban Kana Let’s break dow ...

read moreUnderstanding Mortgage Penalties

May 6, 2025 | Posted by: Kiruban Kana

Many homeowners—especially those without a mortgage broker—don’t fully understand mortgage penalties. And I get it! Financing a home can be overwhelming. But ...

read moreVariable-Rate Mortgages: What You Should Know

April 1, 2025 | Posted by: Kiruban Kana

Shakespeare might have thought ‘to be or not to be’ was the ultimate question, but he wasn’t living in 2025 trying to minimize bank fees and interest charges while maximizing financi ...

read more5 Steps to Improve Your Financial Health

January 6, 2025 | Posted by: Kiruban Kana

Improving your financial health is essential for long-term stability and peace of mind. STEP 1: This starts with creating a budget and sticking to it. Begin by tracking your income and all expenses f ...

read moreUnderstanding Capital Gains in Canada

November 11, 2024 | Posted by: Kiruban Kana

What Are Capital Gains? Capital gains refer to the profit you earn when you sell a capital asset-such as property or investments-for more than its original purchase price. For example, if you bough ...

read moreRefinancing Your Mortgage

November 6, 2024 | Posted by: Kiruban Kana

Refinancing your mortgage can be a smart financial move for many reasons, and as your trusted mortgage advisor, I’ve seen how much it can benefit homeowners! Ideally, refinancing is done at the ...

read more7 Financial Tips for People Looking to Buy an Investment Property in Canada

July 19, 2024 | Posted by: Kiruban Kana

Investing in real estate can be a powerful way to build wealth, but it's essential to approach it with a well-thought-out strategy. Here are seven financial tips to help you purchase an investment pro ...

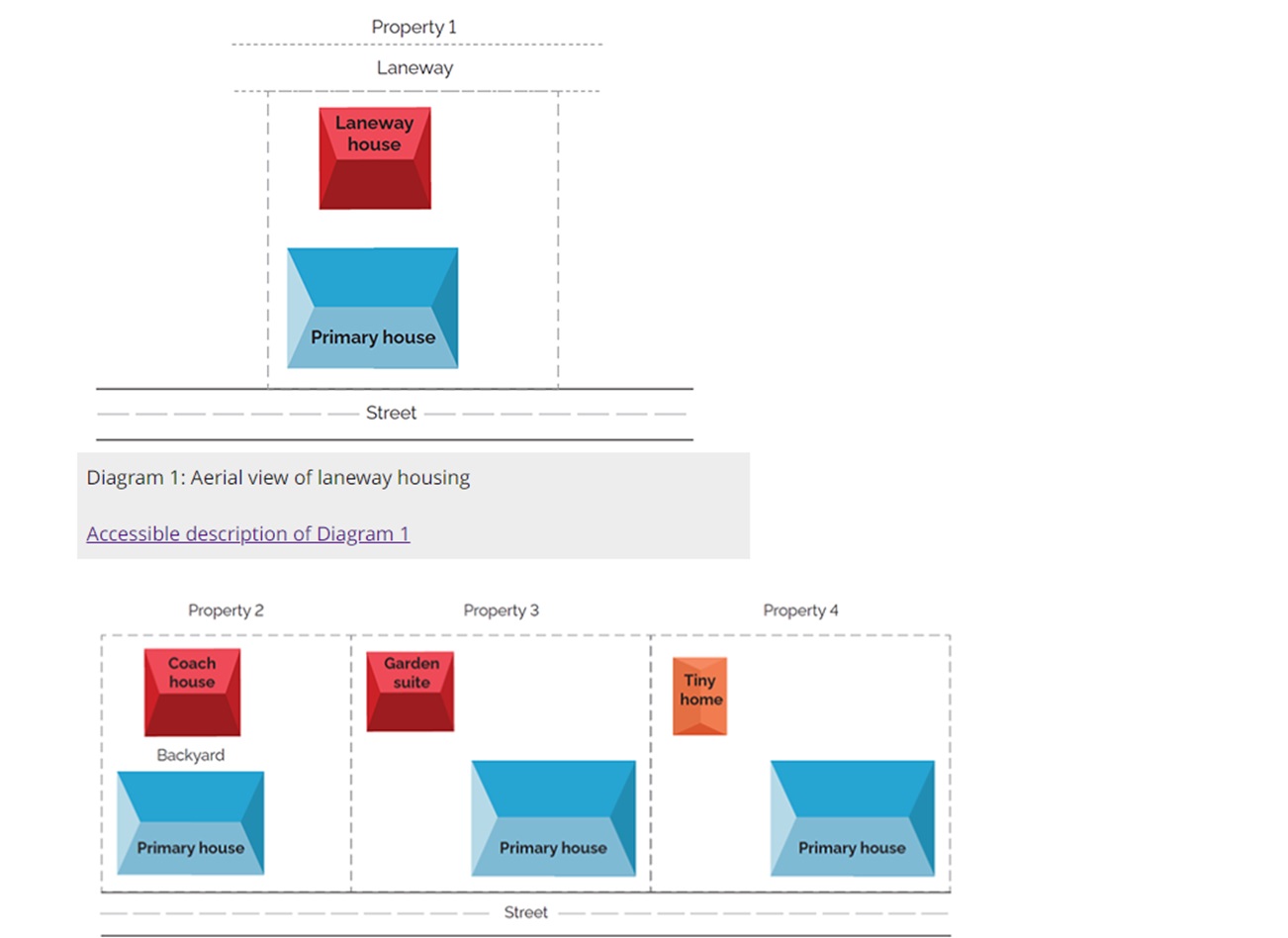

read moreLooking to build a laneway home or garden suite? We can help with the financing options.

July 11, 2024 | Posted by: Kiruban Kana

New Potential with Secondary Suite Financing! Transform your property with the potential to add significant value and create additional income. Whether you're looking to build a laneway home or garde ...

read moreCan I Still Qualify for a Mortgage If My Reported Income Is Really Low? YES!

July 6, 2024 | Posted by: Kiruban Kana

Can I Still Qualify for a Mortgage If My Reported Income Is Really Low? YES! Mortgages for the Self-Employed: A Comprehensive Guide Approximately 15% of Canadians are self-employed, making this an i ...

read moreTips for Improving Your Credit Score Before Applying for a Mortgage

November 6, 2023 | Posted by: Kiruban Kana

Tips for Improving Your Credit Score Before Applying for a Mortgage For many people, buying a home is a significant milestone in their lives. However, getting approved for a mortgage isn't always a s ...

read moreMastering Cash Flow: Thriving in a Rising Interest Rate Market

October 8, 2023 | Posted by: Kiruban Kana

When interest rates rise and you're looking to increase cash flow for your rental property, there are several strategies you can employ. Additionally, CoffeeandMortgage.ca, as a multiple rental and se ...

read moreNavigating Financial Stress: Solutions and Support from Coffeeandmortgage.ca

October 4, 2023 | Posted by: Kiruban Kana

As the financial stress on Canadians intensifies with factors like inflation, rising interest rates, and the cost of living, it's crucial to seek proactive solutions. The survey by the National Payrol ...

read moreDreaming of a Home Renovation? Refinancing May Be Your Solution!

August 25, 2023 | Posted by: Kiruban Kana

Dreaming of a Home Renovation? Refinancing May Be Your Solution! If you've been envisioning a fresh new look for your space but wondering how to make it a reality, let's talk about th ...

read moreEmergency Loans for Home Owners!

August 25, 2023 | Posted by: Kiruban Kana

Introducing CoffeeandMortgage.ca - Your Trusted Mortgage Experts for Over 20+ Years! Life can be unpredictable, but with CoffeeandMortgage.ca by your side, you'll never have to worry abou ...

read moreUnleashing Financial Freedom: How CoffeeandMortgage.ca Transformed Lives and Added $24,000/yr to their cash flow!

August 25, 2023 | Posted by: Kiruban Kana

Dear Ontario Homeowners, I am thrilled to share a heartwarming success story that truly embodies what CoffeeandMortgage.ca stands for – empowering financial freedom and transforming lives ...

read moreCoffee and Mortgage: Embracing Quiet Luxury in Financial Services for Self-Employed Professionals ☕

July 29, 2023 | Posted by: Kiruban Kana

Coffee and Mortgage: Embracing Quiet Luxury in Financial Services for Self-Employed Professionals ☕✨picture credit: https://www.campaignasia.com/ The King of 'stealth wealth': Jeremy Strong a ...

read moreNew Medical Professionals Program: qualify based on the use of future income.

July 17, 2023 | Posted by: Kiruban Kana

☕️☕️ Calling all Medical Professionals! Are you ready for an exciting opportunity that combines your passion for helping others with your dream of homeownership? LLook no further! CoffeeandMo ...

read moreCoffeeandMortgage.ca: Your Mortgage Doctor for Specialized Solutions

July 11, 2023 | Posted by: Kiruban Kana

Let's talk about finding the perfect mortgage. It's just like going to the doctor for your health. Imagine if you walked into a doctor's office and asked for medicine without telling them about your m ...

read moreCanada Adds Guidelines for Banks to Prevent Mortgage Defaults

July 7, 2023 | Posted by: Kiruban Kana

New guidelines issued by the Financial Consumer Agency of Canada (FCAC) urge Canadian banks to assist mortgage holders who are struggling due to a rapid increase in interest rates. The guidelines re ...

read moreDemystifying the Equifax Credit Score: Understanding How It Works - Credit: Part 2

July 3, 2023 | Posted by: Kiruban Kana

Your credit score is a critical factor that lenders and financial institutions use to assess your creditworthiness. Among the various credit bureaus, Equifax is a prominent player in providing credit ...

read moreUnlocking the Power of Credit Scores: How CoffeeandMortgage.ca Helps You Achieve Financial Excellence. Credit: Part 3

July 3, 2023 | Posted by: Kiruban Kana

Here's an additional section highlighting how CoffeeandMortgage.ca, as a mortgage broker founded by ex-bankers, can add value to the understanding of credit scores and overall financial management:How ...

read moreCredit Is NOT like a One Night Stand Sex! Credit: Part 1

July 3, 2023 | Posted by: Kiruban Kana

Now that we have your attention! We're about to embark on a hilarious journey that reveals the unexpected similarities between credit scores and personal relationships. Get ready for some insights as ...

read moreSearching for a solution to your mortgage challenges

June 28, 2023 | Posted by: Kiruban Kana

Hey, everyone! ☕️ ☹️ Tired of hearing those words 'turned down mortgages,' 'refused mortgages,' or 'mortgage denied'? We get it, and we're here to help! Loo ...

read moreBreaking Free: Resolving Mortgage Defaults and Property Tax Arrears with Expertise and Care!

June 22, 2023 | Posted by: Kiruban Kana

When it comes to resolving mortgage defaults and property tax arrears, we understand the importance of experience and expertise. That's why we are proud to introduce Kiruban, our esteemed Vice Preside ...

read moreCanada bank regulator says lenders should urgently tackle risks from mortgage extensions

June 14, 2023 | Posted by: Kiruban Kana

In an effort to mitigate potential risks in the housing market, Canada's banking regulator has urged lenders to address the challenges posed by mortgage extensions. The Office of the Superintendent of ...

read moreTips for helping children buy a home. Strategies to minimize tax implications, including the FHSA

June 13, 2023 | Posted by: Kiruban Kana

The article titled 'Tips for Helping Children Buy a Home. Strategies to minimize tax implications, including the FHSA' by Maddie Johnson provides valuable insights for parents or individuals inte ...

read moreBank Of Canada Rate Update June 7, 2023

June 8, 2023 | Posted by: Kiruban Kana

Bank of Canada raises policy rate 25 basis points, continues quantitative tightening Economic growth leads the Bank of Canada to increase its benchmark interest rate. The key takeaway from the ...

read moreTips to Reduce Mortgage Expenses in a Rising Interest Rate Environment!

June 7, 2023 | Posted by: Kiruban Kana

Tips to Reduce Mortgage Expenses in a Rising Interest Rate Environment! ✨ As interest rates begin to climb, it's crucial to be proactive about managing your mortgage expenses. Here are some handy t ...

read moreFirst Home Savings Account (FHSA)

June 7, 2023 | Posted by: Kiruban Kana

The First Home Savings Account (FHSA) is specifically designed to help first-time homebuyers save for their down payment without having to pay taxes on the interest earned on t ...

read more10 Money Saving Tips!

June 6, 2023 | Posted by: Kiruban Kana

When it comes to saving money, there are a lot of little things you can do that add up to make a big difference! Here are 10 of my favourite money-saving tips to help get you ...

read more☕️ Unlock the Potential of Your Home Equity with CoffeeandMortgage.ca ☕️

May 31, 2023 | Posted by: Kiruban Kana

☕️ Unlock the Potential of Your Home Equity with CoffeeandMortgage.ca ☕️ Did you know that your home could be a valuable financial asset, ready to work for you? If you're looking to refinan ...

read moreGet up to $6M for your equipment, with a flexible 60-month term!

May 10, 2023 | Posted by: Kiruban Kana

Check out this incredible limited-time offer! Get the working capital you need with our exclusive 48-Month Loan!No need for collateral! This non-collateralized loan is a game-changer. Ne ...

read moreWhat to Know about Second Mortgages

April 15, 2023 | Posted by: Kiruban Kana

A second mortgage is a mortgage that is taken out against a property that already has a home loan (mortgage) on it. Generally people take out second mortgages to satisfy short- ...

read moreA Six-Step, Back to Basics Financial Plan for Most Every Canadian

November 21, 2022 | Posted by: Kiruban Kana

It's a tough time to know what the right financial move is at the moment. Interest rates are increasing, while stocks are in bearish territory. It's easy to forget that there are smart things that you ...

read moreRefinancing: What You Should Know

March 6, 2022 | Posted by: Kiruban Kana

Refinancing your mortgage refers to the process of renegotiating your current mortgage agreement for a variety of reasons. Essentially, allowing you to pay off your existing lo ...

read moreImproving Your Financial Direction

January 4, 2022 | Posted by: Kiruban Kana

Make 2022 the year of finance by improving your financial direction from the start! Even if you are living paycheck-to-paycheck, a few changes to the way you spend and look at money ca ...

read moreShould You Refinance Your Mortgage?

December 8, 2021 | Posted by: Kiruban Kana

There are a multitude of reasons why a homeowner may be considering refinancing their mortgage. However, before any final decisions are made it is always a good idea to consider carefully whether refi ...

read more5 Expenses Most Canadians Don’t Expect in Retirement.

December 8, 2021 | Posted by: Kiruban Kana

5 Expenses Most Canadians Don’t Expect in Retirement. According to a recent CIBC poll, nearly half (48%) of retired Canadians stopped working sooner than they expected. The result is ...

read moreWhy You Need an Emergency Fund And How to Get One

December 8, 2021 | Posted by: Kiruban Kana

Building an emergency fund is something most people know they should do but few actually get around to doing. A recent study found that nearly two-thirds of Americans did not have an emergency fund, a ...

read moreStrategies to Dig Yourself Out of the Debt Hole

December 8, 2021 | Posted by: Kiruban Kana

Debt. It's something almost everyone will have at some point in their life. But what happens when your debt begins to get the better of you? What options are available? Some simple strategies can he ...

read more3 Tips on How to Better Your Credit Score

December 8, 2021 | Posted by: Kiruban Kana

Having a good credit score is of paramount essence as it affects your ability to access loans and borrow money. Your credit score rating influences the amount of mortgage you qualify for. You may ...

read moreHow Good vs Bad Debt Impacts Your Household

December 8, 2021 | Posted by: Kiruban Kana

In order to understand the difference between good and bad debt, it's important to track your income and expenses and established saving goals for your family. Financial stability allows you to mee ...

read moreWhat are credit scores and how are they important?

December 8, 2021 | Posted by: Kiruban Kana

A credit score is a number that shows how likely you are to pay or default on credit. It ranges from 300 to 850; the higher the number, the more creditworthy lenders deem you. Your credit history dete ...

read moreHow to Teach Your Kids About Money

December 8, 2021 | Posted by: Kiruban Kana

How to Teach Your Kids About Money. “You’re teaching them way too young,” joked the man next to me and my three girls at the bank machine; clearly he assumed we were taking out cash ...

read more2021 Mortgage Stress Test - Latest Updates

April 21, 2021 | Posted by: Kiruban Kana

On April 8th, the Office of the Superintendent of Financial Institutions (OSFI) announced that it is relaunching its consultation on the minimum qualifying interest rate for uninsured mortgages. Usual ...

read moreApril 21-2021 - Bank of Canada will hold current level of policy rate until inflation objective is sustainably achieved, adjusts quantitative easing program

April 21, 2021 | Posted by: Kiruban Kana

Available as: PDF The Bank of Canada today held its target for the overnight rate at the effective lower bound of ¼ percent, with the Bank Rate at ½ percent and the deposit rate at ¼ percent. The ...

read moreApril 2021-Bank of Canada Releases Results from Consultations on Inflation and Monetary Policy

April 12, 2021 | Posted by: Kiruban Kana

The below details are what has been reported by the Bank of Canada Website Over the past two years, we spoke with thousands of Canadians about their views on the economy, inflation and what the Bank ...

read moreMulti-Family Lending: What You Need To Know About Hard Money Loans

March 8, 2021 | Posted by: Kiruban Kana

Multi-Family Lending: What You Need To Know About Hard Money Loans Multi-family real estate is one of the most popular investments for both newbie and seasoned investors. Buyers in the past used trad ...

read more