Mortgage Blog

Honesty-Integrity-Commitment-Professionalism

Category: Mortgages (12 posts)

Ontario homeowners' guide to debt consolidation and refinancing

January 10, 2025 | Posted by: Kiruban Kana

Build a Debt Elimination Action Plan for Canadians: Take Control of Your Finances. Debt can feel like an overwhelming burden, but with the right strategies and expert guidance, you can regain control ...

read moreSTRONG MAY HOUSING TRIGGERED BOC RATE HIKE

June 19, 2023 | Posted by: Kiruban Kana

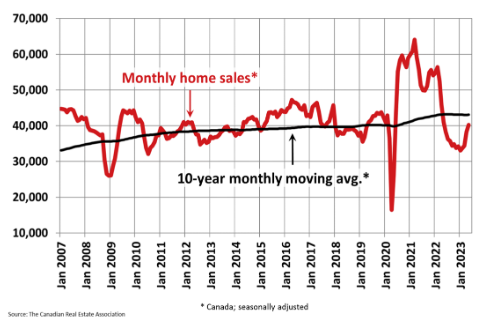

May witnessed a strong surge in Canadian home sales, with a 5.1% month-over-month increase, following a notable 11.1% gain in April. This marked the first year-over-year sales growth in nearly two yea ...

read moreDivorce and Canadian Finances: Navigating the Path with CoffeeandMortgage.ca

May 31, 2023 | Posted by: Kiruban Kana

Divorce and Canadian Finances: Navigating the Path with CoffeeandMortgage.ca Divorce isn't just an emotional journey, it also brings financial challenges, especially for your mortgage ...

read moreMortgages for the Self-Employed

April 14, 2023 | Posted by: Kiruban Kana

Did you know? Approximately 15%+ of Canadians are self-employed, making this an important segment in the mortgage and financing space. When it comes to self-employed individuals seeking a mortgage, ...

read moreGet Your Home Equity Working for You with a Reverse Mortgage.

January 16, 2022 | Posted by: Kiruban Kana

Get Your Home Equity Working for You with a Reverse Mortgage. The notion that we should be mortgage-free is a focus many of us strive to achieve the moment we realize the dream of homeownership. But, ...

read moreHow to Save with a Variable Mortgage.

January 13, 2022 | Posted by: Kiruban Kana

How to Save with a Variable Mortgage. When it comes to mortgages, the age-old question remains: “Should I go with a variable or fixed-rate?”. To make an informed decision, it is imp ...

read moreTake Advantage of Low Interest Rates – Refinance Your Mortgage Today!

December 8, 2021 | Posted by: Kiruban Kana

Borrowers are loving the current record low interest rates, and homeowners stand to benefit even more. If you bought your home more than a few years ago, you could probably benefit from a refinance ...

read moreShould You Spend the Full Mortgage Amount You're Approved For?

December 8, 2021 | Posted by: Kiruban Kana

Before you start shopping for a new home, you'll need to know exactly how much house you can afford. Otherwise, you could end up in a home that is way out of your budget. What you qualify for may not ...

read moreMortgage Broker vs Mortgage Specialist.

December 8, 2021 | Posted by: Kiruban Kana

Mortgage Broker vs Mortgage Specialist. broker vs specialist: what’s the difference? To most consumers outside of the mortgage space, the terms “mortgage broker” and “mortgag ...

read moreHow to Handle a Mortgage After a Separation or Divorce

December 8, 2021 | Posted by: Kiruban Kana

Mortgage Life After Separation and Divorce Separation and divorce present many challenges. It's a situation you likely never thought you'd never be in, but now there are personal and financial conseq ...

read moreWhy Borrowers May Choose a Private Mortgage

December 8, 2021 | Posted by: Kiruban Kana

Why Borrowers May Choose a Private Mortgage When most people want to buy a home, they get a list of local banks and mortgage companies to start comparing the available financing options. However, the ...

read moreShould You Pay Off Your Mortgage Early?

September 2, 2020 | Posted by: Kiruban Kana

It's a dream to be able to pay off your mortgage early, but is there a downside? While it sounds like a great idea, there are some factors to consider before doing so. This article will ex ...

read more