Mortgage Blog

Honesty-Integrity-Commitment-Professionalism

STRONG MAY HOUSING TRIGGERED BOC RATE HIKE

June 19, 2023 | Posted by: Kiruban Kana

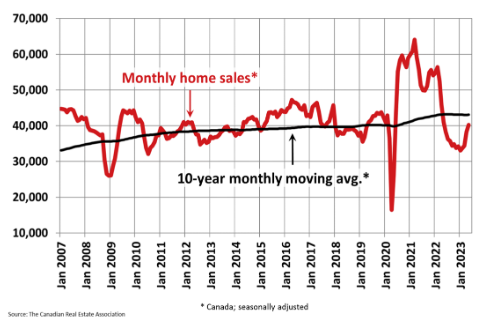

May witnessed a strong surge in Canadian home sales, with a 5.1% month-over-month increase, following a notable 11.1% gain in April. This marked the first year-over-year sales growth in nearly two years. The robust performance of the housing market likely influenced the Bank of Canada's decision to raise its policy rate by 25 basis points. However, the rate hike has dampened enthusiasm in June. Sales and new listings both saw significant gains, contributing to a sales-to-new listings ratio of 67.9%. Despite the increase in supply, inventory remains low. The MLS® Home Price Index rose by 2.1% in May, reflecting broad-based price increases in most local markets. The BoC's rate hike has created a sense of caution in the housing market, leading to a surge in demand for fixed-rate mortgages. As household debt-to-income levels are high, the sensitivity to interest rate changes is a concern. While the BoC raised rates, the Federal Reserve decided to pause its rate hikes. Traders anticipate another rate hike in Canada this year, with the possibility of a rate cut not expected until mid-2024.

Credit & source artice:

https://sherrycooper.com/articles/strong-may-housing-market-likely-triggered-recent-boc-rate-hike/

At CoffeeandMortgage.ca we are always here to help and answer any questions.

Kiruban Kana - Top 5% in CanadaEx-Banker | Vice President & Mortgage Agent Level 1

C: 416-219-4820 | kiruban@coffeeandMortgage.ca

Download contact info

#TaxChanges #PrescribedInterestRate #FinanceNews #CanadaFinance #TaxPlanning #FinancialInsights