Mortgage Blog

Honesty-Integrity-Commitment-Professionalism

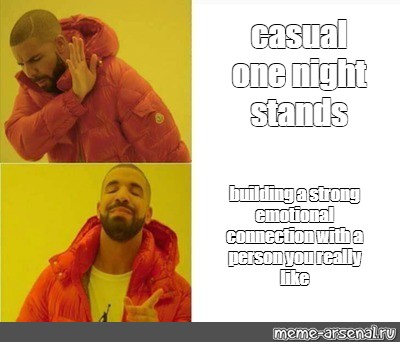

Credit Is NOT like a One Night Stand Sex! Credit: Part 1

July 3, 2023 | Posted by: Kiruban Kana

Now that we have your attention! We're about to embark on a hilarious journey that reveals the unexpected similarities between credit scores and personal relationships. Get ready for some insights as we dive into this three-part blog series on credit and improving your score.

Consistency and Frequency: Just like having a fulfilling love life, maintaining an excellent credit score requires consistency and frequency. Paying bills on time, making regular debt payments, and keeping credit utilization low are like maintaining a steady and satisfying physical connection.

Communication and Transparency: Believe it or not, open communication is essential in both relationships and credit management. Discussing financial responsibilities with your partner and addressing concerns openly can build trust and strengthen your financial future. Similarly, being transparent with lenders, credit bureaus, and financial institutions can prevent surprises and maintain a positive credit history.

Protection and Security: Just as we take precautions to protect ourselves during intimate encounters, safeguarding our financial well-being is crucial. Regularly monitoring your credit report for suspicious activity and implementing security measures, like strong passwords and identity theft protection, can help keep your financial health intact.

Trust and Reliability: Trust is the foundation of any successful relationship, and it plays a significant role in maintaining an excellent credit score too. Demonstrating responsible financial behavior, such as honoring loan agreements and paying off debts, establishes trust with lenders and credit agencies, resulting in a positive credit history.

Long-Term Commitment: Just like long-term commitments nurture lasting relationships, taking a long-term view of your credit health is vital. Building a solid credit history over time, maintaining diverse credit accounts, and avoiding frequent credit applications contribute to a strong credit foundation.

Self-Care and Improvement: Both intimate relationships and credit management require continuous self-care and improvement. Prioritizing your financial well-being through budgeting, saving, and investing in financial education can enhance your credit score, just as personal growth and self-improvement contribute to fulfilling relationships.

Who would've thought that credit scores and personal relationships had so much in common? By adopting responsible financial habits and nurturing healthy relationships, you can pave the way for a satisfying and prosperous future, both financially and romantically. So, as you strive for excellence in your credit score, remember to also cherish the relationships that bring joy and fulfillment to your life. Just as a well-maintained credit score contributes to your financial well-being, a healthy intimate relationship enhances your overall happiness and satisfaction.

Disclaimer: While this blog post draws inspiration from credit scores and personal relationships, it's important to note that they are distinct and separate entities. Always approach personal relationships and credit management with care and in accordance with individual circumstances and values.

At CoffeeandMortgage.ca we are always here to help and answer any questions.

Kiruban Kana - Top 5% in Canada

Ex-Banker | Vice President & Mortgage Agent Level 1

C: 416-219-4820 | kiruban@coffeeandMortgage.ca

Download contact info

- #CreditAndLove

- #RelationshipsWithCredit

- #CreditScoreComedy

- #FinancialIntimacy

- #LaughAndLearn

- #CreditWisdom

- #FunnyFinance

- #CreditScoreTips

- #LoveAndCredit

- #FinancialWellbeing

- #MoneyAndRelationships

- #CreditHumor

- #IntimateFinances

- #CreditRelationships

- #CreditImprovement

- #LaughYourWayToBetterCredit

- #FinanceAndLove

- #CreditHealth

- #RelationshipGoals

- #MoneyMatters