Mortgage Blog

Honesty-Integrity-Commitment-Professionalism

Looking to build a laneway home or garden suite? We can help with the financing options.

July 11, 2024 | Posted by: Kiruban Kana

New Potential with Secondary Suite Financing!

Transform your property with the potential to add significant value and create additional income. Whether you're looking to build a laneway home or garden suite, this unique construction loan offers a fantastic opportunity to enhance your property and community.

credit: https://www.ontario.ca/page/building-laneway-house#chart1

Key Benefits:

- Increase Property Value: Adding a secondary suite can substantially boost your home's market value.

- Generate Additional Income: Supplement your income by renting out the space, making your mortgage more affordable.

- Expand Living Space: Create extra office, guest, or living space for your family.

- Support Your Community: Increase access to housing within your neighbourhood.

- Downsize Conveniently: Utilize the space to downsize without needing to relocate once your children move out.

Who Can Benefit?

- Homeowners with significant equity or a free and clear property.

- Self-Employed Individuals with strong cashflow (with low reported income acceptable)

- Salaried Borrowers looking for innovative financing options.

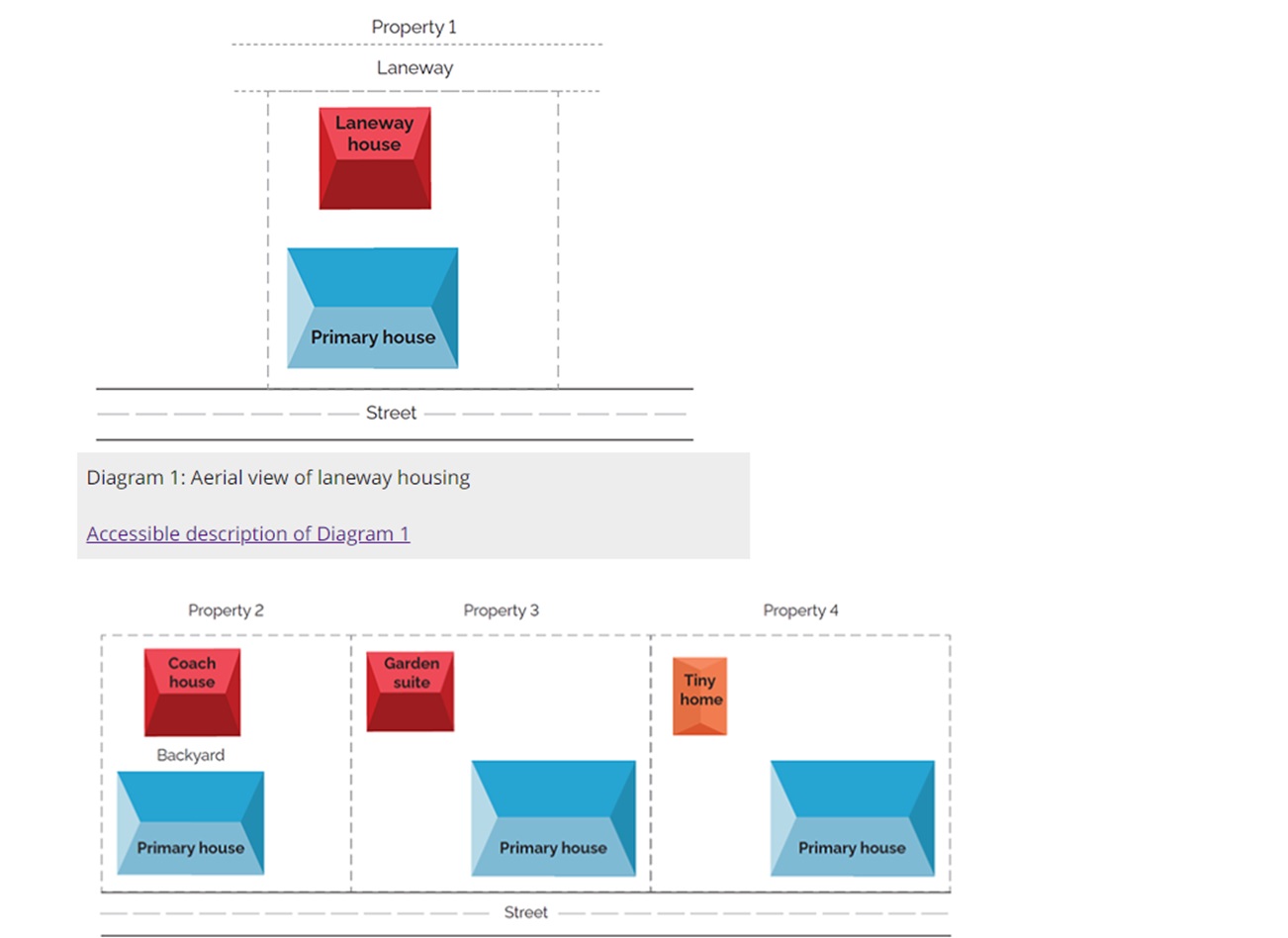

Types of Secondary Suites:

- Laneway Home: A self-contained dwelling above a laneway garage.

- Garden Suite: A separate living space located on your property.

Financing Features:

- Loan Size: Minimum of $200,000.

- Term: 1 year open with interest-only payments.

- Geographic Eligibility: Available in the Greater Toronto Area

- At CoffeeandMortgage.ca, we specialize in helping self-employed individuals secure the financing they need. Even if traditional lenders have turned you down, we can assist in navigating the complexities of mortgage financing to achieve your goals.

Why Choose Us?

- Expert Guidance: Over 23 years of experience in mortgage brokerage. We've helped over 3,050 families to-date and over $1 Billion+ (2014) mortgages underwritten.

- Tailored Solutions: Customized financing options that fit your unique needs.

- Top-Ranked Service: Consistently ranked in the top 1% of our brokerage and top 5% in Canada.

Ready to unlock your property's potential? Contact CoffeeandMortgage.ca today!

Always here to help.

Kiruban Kana

Ex-Banker | Vice President & Mortgage Agent Level II

C: 416-219-4820 | kiruban@coffeeandmortgage.ca

Https://ovou.me/coffeeandmortgage

Self-employed mortgages

Mortgages for self-employed

Best mortgage rates for self-employed

Self-employed mortgage broker

Mortgage financing for self-employed

Self-employed mortgage requirements

How to get a mortgage when self-employed

Mortgage advice for self-employed

Flexible mortgage lenders

No tax return mortgage lenders

Mortgage solutions for self-employed

Self-employed mortgage guide

Can I still qualify for a mortgage with low reported income

#SelfEmployed #Mortgages #MortgageBroker #SelfEmployedMortgages #MortgageAdvice #Finance #RealEstate #MortgageRates #SelfEmployedBusiness #HomeLoans #CoffeeAndMortgage #FlexibleLenders #MortgageGuide #MortgageSolutions #BusinessOwnerMortgage #MortgageRequirements #CanadianMortgages #RealEstateTips #MortgageSupport

#MortgageSolutions #SelfEmployed #PropertyValue #LanewayHomes #GardenSuites #RealEstateInvestment #Toronto #CoffeeAndMortgage